With that being said, for those who can stomach the ups and downs of flipping, there is potential for decent profits if you know what you’re doing.

And even though I am by no means an expert on this stuff, I’ve learned quite a few things over the years that help make flipping houses easier (and a little more realistic) for those just starting out in the flipping world or those who are still just dreaming about flipping houses.

So without further ado here are…

4 Of My BEST Beginner Tips for Flipping Houses

4 Of My BEST Beginner Tips for Flipping Houses

Know What You’re Getting Into

There’s a lot involved when it comes to flipping. Most people think it’s as easy as: 1. Buy a house, 2. Fix it, 3. Sell it. But from an insider’s point of view I’m telling you that is NOT the case, especially with the “buy a house part.”

First, most flip houses actually don’t result from a typical sale that most home buyers experience – typical meaning a homeowner puts their home up for sale while still living it, agents make appointments to show their buyers, it sells to one of said buyers and you go to closing on a specified date and the home is now yours.

Nope.

There are courthouse auctions, front yard auctions, online auctions, banked owned sales, private sales, HUD owned sales, and estate owned sales. All of these sales can result in weird complications that no one involved has ever encountered before!

These complications can drag out the offer process, inspection process and even the closing process!

That’s what happened to us when we purchased our HUD owned fixer upper home. We technically paid on our home from July 1st of 2016 but weren’t “allowed” to go inside until July 7th! So just be careful!

Find the Right House

If I could give only one piece of advice to someone thinking about flipping a house it would be this: find the ugliest house in the best neighborhood. My two biggest criteria for determining “a good neighborhood” are that the crime rates are low and it has a good school district.

Good schools are desirable. Picking a home in a neighborhood with good schools usually leads to not just a higher profit but a quicker sale. Also consider what size and type of house is most likely to sell in a neighborhood before purchasing. If 3 bedroom 2 bathroom homes are selling like hot cakes and the 2 bedroom 1 bathroom homes all sit on the market for 90+ days, I’d say to steer clear of the 2 bedroom 1 bathroom unless you have time (and extra money in holding costs) to sit on the house.

Whenever I’m curious about crime rates in a certain area I turn to good old google. Most of the time I’m brought to the county police department’s website and there they usually have interactive maps showing all the different crimes and even what types of crimes have been committed in the area – because that’s kind of important too.

Set a Minimum Profit

Before you even begin searching for houses I recommend setting a minimum profit you want to make off this venture. And then I want you to STICK TO THAT. From personal experience, it’s really hard to separate your feelings for a house with the business you want to do with the house.

I recommend setting a minimum of 20% profit. This means you’ll have to estimate the ‘after’ price or ARV, after repair value, of a potential house. A realtor can usually give a good idea of what other fixed up homes in the area have gone for recently and what they are listed for currently. I NEVER rely on Zillow’s “zestimate” because it’s merely an average of all the homes that have sold in a particular neighborhood. It doesn’t take into account the condition of the homes and whether or not it was a bank sale or short sale.

Once you determine the ARV you’ll deduct your 20% profit right off the top. Then you’ll need to deduct your estimated renovation costs, holding costs and seller’s fees (transfer tax, commission, etc.) Once you’ve done that you have the highest offer you can possibly put in… but don’t start with that! It’s annoying I know, but it’s just like car sales, most of the time you wind up negotiating so start low.

Read These Books

I am always listening to books on audio while I’m working on all my home improvement projects, I feel like it’s a great way to multitask and I always learn something new to boot! I’ve been on a health kick recently so most of my audible library looks like this, Eat Dirt, Whole

and The Big Leap

(which is more about entrepreneurial endeavors than health.)

Anyway, the first book I recommend is this one, The Subtle Art of Not Giving a F*ck. If you’ve ever had any fears about putting yourself out there and taking risks this book will give you courage to say “who the fuck cares” and go for it. I’m definitely not saying do I what I did and randomly quit your corporate job with no plan, but it’ll help put a stop to those doubts and fears about doing something outside your comfort zone.

Secondly, and more on topic, is this book FLIP. I’ve read it twice now and am even thinking of reading it a third time because I always take away something new each time. It does a great job of going over the entire process of flipping a home. From finding the home, assessing value and renovation costs to selling, the book covers most every topic imaginable when it comes to buying and selling a residential flip. The best part about the book is that it’s not too technical and is in “layman’s terms” so the average, non investor, can understand it.

And there you have it… my four first and best tips for flipping houses!! It definitely takes a certain personality to deal with the ups and downs of flipping houses but it’s also definitely one of the most fun and rewarding experiences in life, especially when you get to do it with your best friend and love of your life!

Don’t forget to subscribe at the top right of this page to get notifications when a new post is up!

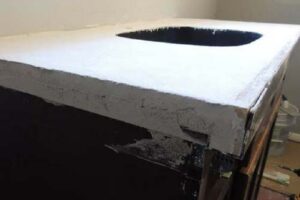

Oh and have you checked out the house we flipped? Here are the before and after photos!

I know I’m starting to ask a lot of you but let’s connect on Instagram, Pinterest and Facebook!

Here are some other posts you might enjoy:

Welcome to Beech Street (#01-01)

January 2022 we bought a triplex and I’m sharing all the fun details – the numbers and the before pictures!! Check it out and let me know what you think!

House Of Loyal Socks | The Numbers!

Some were brave enough to ask so here it is… the flip house numbers! Purchase price, ARV, budget and profit. Read what we paid, what we expect to sell for, what our budget entails and how much we plan to make (or lose!)

What’s the Difference Between Pre-Approval and Pre-Qualification

You might be wondering to yourself, or out loud to google, ‘what’s the difference between pre-approval and pre-qualification?’ And it’s not a bad question to have seeing as though most people use the words pre-approval […]

How to Get a Good Deal on a House Through the MLS

Looking for how to get a good deal on a house through the MLS? Perfect! Because today’s blog post is all about just that. There are so many more ways to find a house other […]

DIY Lighted Bottles

I’ve always wanted to make a DIY lighted bottle for my home decor! I finally made one and love the way it turned out. It’s so easy you probably don’t need a tutorial, but here’s a quick one.

Hair Today Gone Tomorrow

I am such a nerd. I cracked myself up when I came up with the title hair today gone tomorrow. Even though it definitely won’t help me “rank in google” I think you get the […]