Hellllllooooo Beech Street!!

Let’s all say hello to Beech Street – a local triplex we picked up in January 2022!

This beautiful building built was built in 1910 and has a three bedroom apartment, two efficiency units and a 1.5 car garage with it’s own electric.

What are our plans for Beech Street?

The plans for Beech Street have changed So. Many. Times.

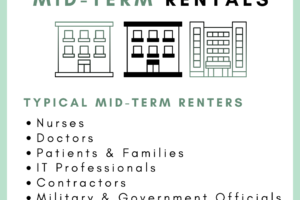

I’m learning to go with the flow so all I can say is, as of now, our plan is to rent the entire building out to traveling professionals coming to the area as well as patients & their families coming in for care/treatments. It’s been working out soooOoooOOOooo well since we decided to convert our long term rentals to medium term rentals at the end of 2021 that I think we’ll stick with it for a while… that is until we need to pivot our investing strategy yet again 🤣

We’ve thought of converting the whole building into an Airbnb, doing half Airbnb & half long term rentals, all medium-term furnished units, I’ve even thought of adding more section 8 units to our portfolio! And don’t get me started on what to do with the garage, that’s a whole other ball game with crazy ideas.

We inherited two tenants with the building, the garage tenant and a tenant in the studio. We put the decision in their hands as to whether or not they wanted to stay on as a “regular tenants” (for us that means signing a new lease – with an increase in rent – and continuing to pay their own utilities) or if they’d like to vacate. Spoiler alert, they both gave notice! – One vacated early and the other is vacating at the end of March and I could not be more ecstatic!! I love starting fresh.

I’ll post more details about each unit soon but in the meantime, here’s what you probably came here for… the numbers and the before photos!

The Numbers

We purchased the triplex for a total of $185,000. It was at 50% occupancy and bringing in a whopping $675 a month.

We’ve sunk about $5,000 into it so far and will likely spend another $35,000 to get it up to our standards.

Even though we’re doing medium and short term rentals, I still analyze properties as if they are going to be long term rentals because I always want to ensure I have a fallback plan where, worst case scenario, I’ll at least break even. But my true goal is a minimum of $100/mo cash flow per door.

The Rents

Unit 1 is a studio apartment and would rent for $850/mo.

Unit 2 is a 3 bedroom apartment and would likely rent for $1,500/mo

Unit 3 is a large studio apartment with bonus space and would rent for $950/mo.

Lastly, the garage could rent for $300/mo.

So, if we were to rent the triplex out long term, we’d bring in $3,600 gross monthly income. Don’t forget that GROSS means before all expenses, mortgage payments, etc. are accounted for. So after all expenses and accounting for capital expenditures, repairs, management and vacancy we net $680.

So, if I include the garage as a unit, my goal is to make a minimum of $400 per month on the property if I were to rent it out on a long term lease… and as you can see I exceed that by $280/mo!

So with that as a solid base and knowing my fall back plan is a very viable option – I moved onto analyzing the property as a medium-term rental. I’ve been analyzing and tracking the market in Pottstown for months prior to buying there and after accounting for increased expenses like having to pay for all the utilities and internet for the building, we have the potential to net $1,230/mo, which is over $500/mo more and totally worth the extra effort!!

For my real estate investor besties out there here are some extra deets (note that these are future numbers and are based on our strategy of medium-term rentals and after we rehab and refinance):

The Deets

Total Cash Invested $40,800

Cash on Cash Return 36%

Pro Forma Cap Rate 11%

Monthly cash flow $1,230

So technically this is a BRRRR but unlike our first BRRRR, we’re leaving a good chunk of our own money in this deal. (Which means I REALLY need to get on with finding some more private lenders!!)

Woahhhh now!! Does it sound like I’m talking gibberish? What’s a BRRRR, what does it mean to leave money in the deal?

For those that aren’t familiar, BRRRR is an acronym that stands for Buy – Rehab – Rent – Refinance – Repeat.

So the idea is that you purchase a distressed property, renovate the building, find and place some tenants and then refinance for more than you purchased it for. And then, of course, the last R – repeat the process over and over again. This is a great way for investors to recycle their money because in an ideal scenario – the investor gets all of their purchase AND rehab money back when they refinance – and in the bestest most grooviest case scenario the investor also gets some additional money back.

So what do I mean by “we have to leave money in the deal?” In our scenario, when we go to refinance in a few months, we won’t be getting all of our purchase and rehab money back so we’ll be “leaving” money in the deal as equity- unrealized equity, yes – but equity nonetheless!

The Photos

To keep this blog “light” I won’t be posting all the photos directly on here… you’ll have to head over to my Instagram account or Facebook page. You can find all the before photos on the highlights on my Instagram and/or in a nice neat organized little album on my Facebook page.

But to satisfy a teensy bit of your urge to see the photos right now… here are a few before photos of the triplex and it’s units.

There you have it… the details of the latest acquisition that I’ll be *trying* my best to share allllll the nitty gritty details on… Again, don’t forget to follow me on Facebook or Instagram where I post in stories all week long about the progress of our various projects!!