There are so many more ways to find a house other than through the MLS (Multiple Listing Service).

There are HUD homes, auction homes, foreclosure homes, private sales and so much more!!! But the majority of people use the MLS to fuel to their home search. For those wondering, the MLS is the “multiple listing service” in which most all real estate agents collaborate to buy and sell homes through one central listing system. The listing system is location specific, so where I live the local MLS (also called Bright) covers Delaware, New Jersey and Pennsylvania.

But no matter what multiple listing service you use, read my post below on how to get a good deal on a house through the MLS.

My 6 Tips on How to Get a Good Deal on a House Through the MLS

1) Act Fast

You may have heard this one before but it’s truer than the fingers on your hand. If you want a good deal, you have to be willing to move fast. Investors are your biggest competitor in the fixer upper market and they understand how to move fast which means you have to move fast.

Seriously, it’s not uncommon for a home to go on the market on a Friday afternoon and by Saturday morning it’s under contract. The truth is you may not always be able to “see it Monday” because it might not be there! If you think you might like a home and your real estate agent believes it might be a quick sale, don’t drag your feet.

2) Get Pre-Approved (Not Pre-qualfied)

Even though most people use the words pre-approved and pre-qualified interchangeably they actually aren’t! Ask a lot of real estate agents and they’ll tell you to put that pre-qualification right in the trash. Why? A pre-qualification only means that a lender looked at you and whatever you told them about your financial situation and they said “yeah, you’ll probably get approved.”

Pre-qualification is a fine place to start for those just starting on their house hunting journey and especially for those who have no clue what kind of mortgage they can afford. And most agents will show houses to people who have only been pre-qualified, however the issue comes when you need to make a quick offer and aren’t read with a pre-approval. I leave it up to the clients but continually remind them they could lose out by not having a pre-approval ready to go.

A pre-approval is much more desirable and often times required by home sellers. It shows you’re ready to purchase as long as you pass the final underwriting (meaning don’t make any purchases, change jobs or do anything that will change your credit before you close.)

3) Pay In Cash

Even better than a pre-approval letter is paying in cash. You’ve heard it before and I’ll say it again, cash is king in real estate. There are a lot of problems and issues that can arise during escrow when getting a mortgage and most sellers know this. So in order to avoid unforeseen issues with a mortgage, a seller may leans towards accepting a cash buyer’s offer, especially a cash buyer who also removes the inspection contingency which I’ll go over next.

4) Remove Inspection Contingency

This is terrible advice I do not recommend this to anyone who doesn’t have a solid understanding of all that goes into a home. Inspections can reveal things like leaky roofs, foundation issues, electrical problems, termites and more so if you don’t know how to inspect these items, get an inspection.

It’s scary but removing the inspection contingency could really help with getting a house fast, quick and cheap but again make sure you are comfortable doing so. Lastly, when removing the inspection contingency make sure you have an emergency fund for unknowns in addition to the budget you created.

5) Research & Keep Notes

Ideally you’re working with an awesome real estate agent who keeps track of all the homes you’ve seen before and has alerts set up to be notified when an ideal home for their client (you) is listed. Besides that, she should also be regularly checking to see if any homes you’ve seriously liked in the past but missed out on have come back on the market. This way, if you really don’t want the home to get away a second time, you’re in the perfect position to use tip #1 and act fast.

6) Close Fast

Like I mentioned above, sellers know that lots can go wrong during escrow. For that reason, some sellers want escrow to be as fast as possible to avoid issues like the whole deal falling apart because the buyer decided to open a new credit card one week before closing!

If using a mortgage company, you can only close as fast as the mortgage company can work. A typical escrow period is about 45 days and can be up to 90 days for special programs! So if closing fast is important to the seller talk with your mortgage officer to see how quickly they can get you to the closing table. And feel free to shop around to multiple companies, there are ones out there that specialize in closing fast.

There you have it, my 6 tips on how to get a good deal on a house through the MLS! Using the multiple listing service might be what everyone else is doing, but using all or a few of these tips might help you land the home of your dreams!

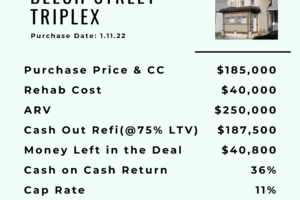

You also might want to check out this post on 5 Way to Find a House to Flip, especially if you’re looking for a fixer upper!

If you’re interested in the real estate market, check out this post I wrote about How Millennials are Changing Real Estate.

And lastly, check out this post all about HUD homes!! It’s a very good way for owner occupants to find a good deal on a home!

Subscribe!

Be sure to reach out on Instagram; Facebook; or Pinterest; and subscribe to this blog to be notified when new blog posts are up – who would want to miss those!?! (And if you’re a fellow blogger submit your website! I love finding new blogs to read, pin and share!!! It’s so hard to find a good quality blog nowadays, you know what I’m saying?)

[contact-form-7 id=”3255″ title=”Contact form 1″]